Learn more at AgingWellMetroDC.com

“Aging in place” — care at home

Support is available for those who wish to stay at home. However, one-on-one care is expensive. And it’s not always easy to find caregivers. Community services can sometimes be patched together.

Support is available for those who wish to stay at home. However, one-on-one care is expensive. And it’s not always easy to find caregivers. Community services can sometimes be patched together.

To stay at home, it helps to have a knowledgeable person check in periodically who knows eligibility requirements and can supervise and coordinate all the players.

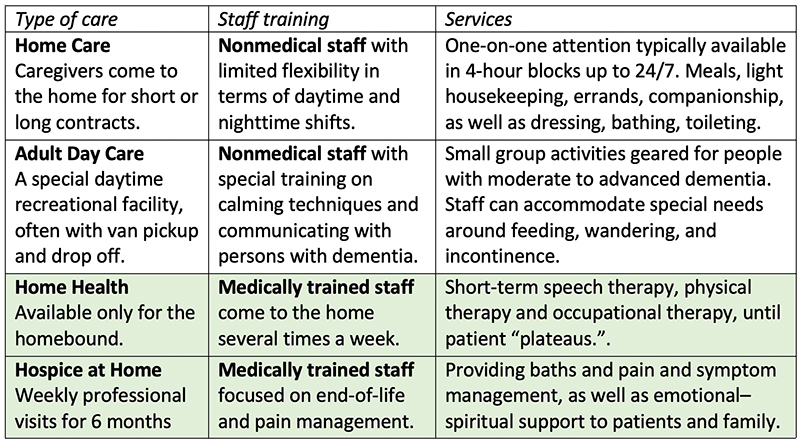

Home care. People who do not need medical attention, but simply help with household activities, running errands, or light companionship, benefit from home care. The key to success is finding a good match between the caregiver’s personality and your own.

Adult day care. If someone is available for nighttime care of a person with dementia or light medical needs, then adult day care can provide engaging daytime activities, meals, and relief for the caregiver. Ideal for working families or a spouse who needs a break.

Home health. Patients are able to leave a skilled nursing facility yet continue receiving needed therapy through visits at home. This is a short-term service, ending when the patient has improved as much as can be expected.

Hospice at home. Hospice is for people with a life expectancy of up to six months who opt for improved quality of life over the hardships of treatment. Nurses visit at home a few times a week to monitor pain and comfort and to support families as nature takes its course.

Call us at 301-593-5285 to start the planning process for aging in place.

Paying for care at home

Home care $$–$$$$

The cost of nonmedical home care is NOT covered by Medicare. As a result, you must contract directly with providers. Fees depend on how many hours a week your care requires. Consider that caregivers coming to your home need a livable wage. Add to this agency costs of staff recruitment, vetting, training, and scheduling. The price can mount up quickly.

- Long-term care (LTC) insurance. These policies can be purchased privately and are the least expensive when begun in middle age. Typically, to draw upon the insurance, you must pay for home care services out of pocket for a waiting period. Insurance will contribute afterwards and pay up to the lifetime cap. Check policy details.

- Veterans assistance. For qualifying vets who saw active duty with at least one day during a war, there may be benefits available to help with the costs of home-based care.

- Personal savings. Consult with a financial planner and elder law attorney to determine the best strategy for liquidating assets to cover your care.

Adult day care $–$$$

You must pay privately. Many programs are run by nonprofits so are underwritten by donations. Medicaid, LTC insurance, and veterans benefits may also help.

Home health and hospice $

- Medicare. This is typically deducted from your Social Security check and will cover home health services (80%) and hospice (often 100%).

- Supplemental insurance. This is insurance you buy to cover the 20% balance not paid by Medicare.

- Medicaid. Those with VERY low income and minimal assets may qualify for state government support. The eligibility requirements are stiff. Coverage includes 100% of most medically trained care, with some restrictions. Coverage for nonmedical care is spotty and varies by county.

Choosing a provider

Frank knows they need help at home. His wife’s dementia is getting worse, and he has his own health problems. She can’t be left alone anymore. Doing all the cooking and cleaning, and now helping her with bathing … it’s just too much. Frank needs to take breaks. But Google reveals a dizzying array of home care providers. How to choose?

Allowing a stranger into your home can leave you feeling quite vulnerable. It’s important that you trust the individual and the company that does the background checks, verifies training, and puts together the schedule. You need to interview each company to find out pricing and minimum number of hours. Also about independent quality ratings.

How do you know which one to trust? On the basis of past experience with other clients, an Aging Life Care™ Manager knows which companies put an emphasis on training. Which have difficulty filling a shift if a caregiver calls in sick. Which have high staff turnover resulting in the need for you to orient a new employee every few months. Which have a team of employees who love their work.

Wise home care companies will let you and your Aging Life Care Manager interview caregivers before making a choice. They know that an Aging Life Care Manager understands you and understands what will result in an optimal match.

Both you and the provider and the caregiver want a good fit the first time so all of you can work together positively for the duration of your need. It makes the difficult transition to home care that much easier if a knowledgeable advocate can set expectations and provide an objective viewpoint.

Even with adult day care and medically trained services, not all providers are alike. An Aging Life Care Manager knows the reputation and management style of each company, and can look up Medicare reviews and complaints.

An Aging Life Care Manager can also coordinate care across multiple services and work with your doctor to ensure all the different players are aware of your changing needs.

To learn more, call us at 301-593-5285